If you’re looking to sell your home it’s important to establish an accurate property valuation, and you can do that by using our house price calculator.

The estimated value of your home can vary drastically from estate agent to estate agent. Some will overvalue your home to win your business! Others may undervalue your home to achieve a quick sale and hence a faster pay day!

Unfortunately valuing your home is not an exact science. There are many things that can affect the value of your home such as condition, the economy, the potential of the property to extend, outdoor space, transport links, school catchment area, area crime rates, environmental risks and more. But putting a specific value on each of these isn’t really possible or indeed feasible.

The easiest way to value your home is based on cold, hard statistics with a sprinkling of common sense (I’m making an assumption that you have common sense!).

We don’t currently recommend automated valuation models (AVM) to obtain instant property valuations, since their valuations can vary drastically. And now isn’t the time for guesswork!

Just follow these 5 simple steps to obtain an accurate valuation of your home.

Step 1: Previous Sold Prices

The first step is to find out if your property or a neighbouring property of similar specifications has previously sold in recent years. If so this is great news since it makes our job a whole lot easier. It generally flags to us that this is the price people were willing to pay for the property at that time and in that condition.

To find out you can check the two biggest property portals – Rightmove and Zoopla. If the property has been previously listed on the portal, you may be lucky enough to find a cached version of the advertisement. If you can find your exact property, great. If not try and find one that closely matches your property based on location, property type and condition.

Example (take note of the bold parts): I have found out that the semi-detached property I am selling in Stockport previously sold in March 2013 for £171,000. The condition was average at the time of sale.

Step 2: Local House Price Trends

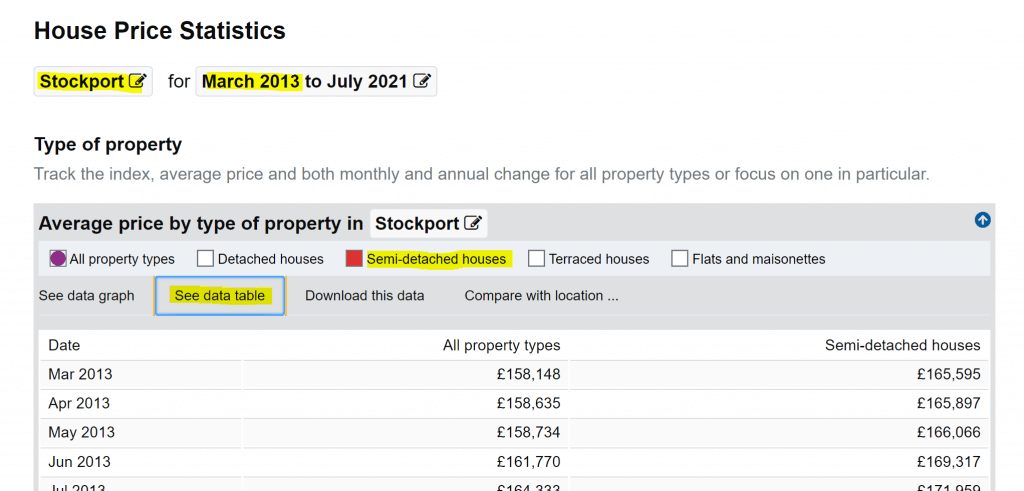

The second step is to consult the house price index since this enables us to establish trends in the property market – has the average selling price of properties in Stockport increased or decreased over a specified period of time? To continue with our example above we will take you through this step by step:

1. Go to the Land Registry House Price Index page.

2. Change the location to Stockport (it’s advisable to click on the Local Authorities tab since it allows more location-specific data) and set the date range from March 2013 (when it previously sold) to now (today’s date).

3. Now change the property type to be semi-detached to reflect our property.

4. Now click on ‘See data table’.

I have highlighted these 4 clicks below.

Example: We can see that when the property previously sold in March 2013 the average price of a semi-detached property in Stockport was £165,595. We can also see that in January 2018 (the most recent statistic at the time of writing) the average price of a semi-detached property in Stockport was £229,247.

Step 3: Calculate Your Estimate

Now substitute the previous average property price (when the property last sold – in the example above it is £165,595), the current average property price (the average property price in today’s market – in the example above it is £229,247) and previous actual sale price (the price that the property previously sold for – in the example above it is £171,000) into the calculator below to calculate the estimated current value of your property!

But wait! We’re not quite finished.

As a general rule of thumb:

- If you have redecorated throughout, you can add 2% to the estimate above.

- If you have added a conservatory, central heating, a new bathroom, a new kitchen or landscaped the garden you can add 5% for each item to the estimate above.

- If you have converted the loft space into a habitable room or built a house extension, you can add 10% for each item to the estimate above.

The condition of the property during the previous actual sale price was average. It’s now much better and has been redecorated throughout.

If we had installed a new kitchen and redecorated throughout we would add 7% (5% + 2%). In this example based on us only redecorating throughout, let’s increase our estimate by 2%:

Step 4: Get A Third Party Estimate

As with most things in life it’s always prudent to get another opinion. Ask another estate agent to value your home, but don’t reveal your estimate from above! You don’t want to sway them in any direction. Be aware of estate agents incorrectly overvaluing your property just to gain your instruction! And if you obtain a property valuation from more than one estate agent, calculate the average of them all.

Example: Two other estate agents valued my property at £220,000 and £240,000. The average of these values is £230,000.

Step 5: How Much Is My House Worth?

Finally, input your answers from steps 3 and 4 below to find your proposed sale price:

Now that you have an accurate property valuation, it’s time to list your property! We have free plans and premium plans to choose from!